B2W Software for Construction Pays Off for Payroll Processing

More Efficiency and Accuracy with Construction Software

![]() An article in Building Profits magazine focuses on using technology to eliminate payroll errors and inefficiencies.

An article in Building Profits magazine focuses on using technology to eliminate payroll errors and inefficiencies.

“When you’re using paper, there are a lot of data issues that arise,” says Eric Sellman, a vice president and general manager at M.A. Mortenson. “Handwriting can be an issue. People can put hours against task codes that maybe they shouldn’t be assigning those hours to.”

Patrick Holland, Vice President at A.J. Coleman & Son describes the payroll information transfer prior to adopting B2W Track as time consuming, slow and not very accurate or reliable. “Information was submitted weekly, and there were weekly disputes, depending on the diligence of the supervisor’s input,” he adds.

Several contractors using B2W Track cut the payroll processing workload in half while gaining a more accurate and immediate picture of how labor is impacting their jobs.

“There are a number of tangible examples of how a system like this improves our operation and ensures that we are paying the men and women that work for us timely and correctly each week,” concludes Mark Galasso, President at Lancaster Development. “We were able to reduce our payroll staff by a little over half and went from having one, two or sometimes as many as three payroll errors per week to less than three per season now. We’ve made a radical improvement in our accuracy and timeliness.”

Fewer Violations with Electronic Field Logs

![]() The complexity of a high number of hourly workers, rate classes and prevailing wage requirements is why construction typically outpaces all other industries in labor violations. This article in Construction Outlook magazine outlines how electronic logs make it easier to avoid costly penalties.

The complexity of a high number of hourly workers, rate classes and prevailing wage requirements is why construction typically outpaces all other industries in labor violations. This article in Construction Outlook magazine outlines how electronic logs make it easier to avoid costly penalties.

In Massachusetts alone, where the publication is based, the state Attorney General’s office assessed construction companies $2.5 million in penalties and back wages on behalf of more than 500 employees in its most recent fiscal year ending June 30, 2020.

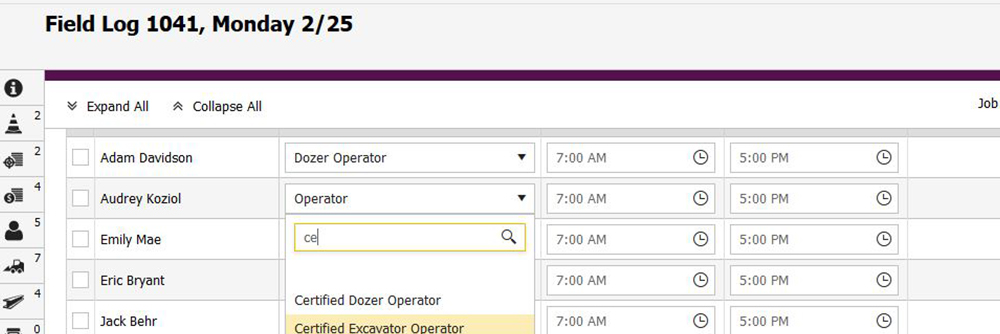

Electronic logs help contractors capture hours in a structured, consistent and easy manner and to do it daily when the information is current. Error check features in the software guard against common mistakes.

Labor types available on a field log are also limited to employees and work types associated with the particular project. This takes away guesswork and searching for codes, making it less likely managers in the field will classify hours incorrectly. Finally, coding correctly in the field and transferring the data electronically to the payroll system eliminates communications chaos, redundant data entry and – again – opportunities for mistakes.

“Accuracy and timeliness are the essential goals in time capture and payroll processing, and that is what you gain with an effective, software-based system,” concludes Rich King, CFO at Schlouch, Inc. “Contractors need to pay employees correctly and they need labor hours assigned to the proper cost codes and visible right away so they can monitor job performance against the estimate,” King adds.

Leave a Reply

Want to join the discussion?Feel free to contribute!